-

Visit the “Borrow USDL” page.

- Connect Your Wallet

-

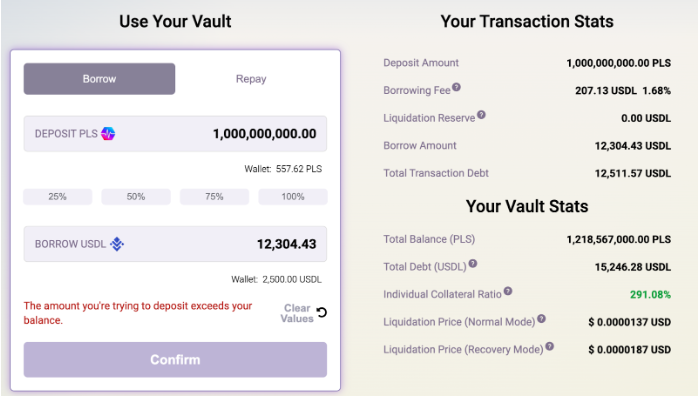

Choose the amount of PLS you want to stake. The Dapp allows you to select a custom amount or choose from 25%, 50%, 75%, or 100% of your current balance.

-

Under “Transaction Stats” you will see:

- The Total Amount of PLS you are temporarily locking up. This amount will become your collateral and will be added to an existing position if you have one.

- The total borrowing fees you will pay to the LOAN Staking Pool as a percentag e of the amount of borrowed USDL

- The Liquidation Reserve is 200 USDL set aside from your total borrowed USDL. This reserve pays the Liquidator if your vault is liquidated. The LR is returned to you when you close your vault out.

- Your “Borrow Amount” is the total USDL you will receive.

- Your “Total Transaction Debt” is the amount of USDL you would have to pay back in order to receive that amount of PLS collateral back.

-

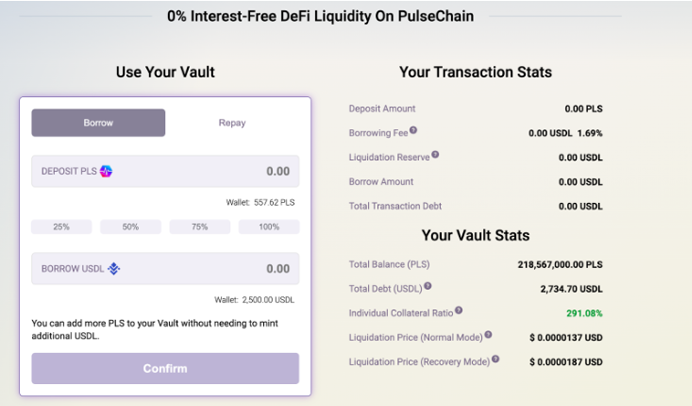

Under “Your Vault Stats” you will see these stats as a result of your new transaction:

- Your Total Balance of collateralized PLS

- Your Total Debt which represents the amount of USDL you would have to pay in order to get your Total Balance back.

- Your “Individual Collateral Ratio” is the value of PLS divided by the value of your debt x 100.

- The Liquidation Price(s) are the price of PLS which would result in you losing your PLS but keeping your USDL.

- Click “Confirm” and “Confirm” again to execute the transaction in your wallet.

-

Your USDL will be automatically generated and “sent” to your address.

***If you need help deciding on a collateral ratio to best manage your vault, visit the modules on How To Avoid Liquidation and How To Avoid Redemption***